Home sale capital gains tax calculator

More About This Page. For tax saving purpose have a investment property more than a year saved a lot tax.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Our home sale calculator estimates how much money you will make selling your home.

. How Federal Property Taxes Work. Property taxes are taxes levied on real estate by governments. Desired selling price 302000.

Capital Gains Tax on Sale of Property. Discover Helpful Information And Resources On Taxes From AARP. One factor this calculator does not take into account is capital gains.

And 500000 married filing jointly in gains. 2022 capital gains tax rates. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

You must report and pay any Capital Gains Tax on most sales of UK property within 60 days. Calculate your capital gains taxes. 2021 capital gains tax calculator.

ESTIMATED NET PROCEEDS 269830. Real estate property includes residential. Calculate your capital gains taxes and average capital gains tax rate for the 2022 tax year.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The current federal limit on how much profit you. According to IRS topic 701 homowners selling their primary residence.

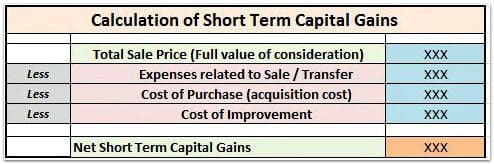

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. If you have Capital Gains Tax to pay. Calculate the Capital Gains Tax due on the sale of your asset.

Visit The Official Edward Jones Site. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. For example if your annual gross income tax is 85000 as a single filer with a real estate capital gain of.

Use HomeGains Capital Gains Calculator to determine if your gain is tax free or how much capital gains tax is owed from the sale of a property. 250000 of capital gains on real estate if youre single. In 2021 single filers with an income over 40400 pay a 15 federal tax on long-term capital gains and a 20 federal tax if their income is over 445850.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. In this example subtract 330000 from 950000 to find your gain equals 620000. FAQ Blog Calculators Students Logbook Contact LOGIN.

Subtract your basis from your proceeds to calculate your gain on the sale of your personal residence. Calculate Capital Gains Tax on property. 500000 of capital gains on real estate if youre married and filing jointly.

Investors can lose over 37 of their capital gains to taxes. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. But there is an option for deferring capital gains taxes from the sale of an investment property by reinvesting the proceeds.

Capital Gains Considerations When Selling a Home. New Look At Your Financial Strategy. The IRS typically allows you to exclude up to.

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. Calculate the Capital Gains Tax due on the sale of your asset.

Capital Gains Tax On Sale Of Property I Tees Law

How To Save Capital Gain Tax On Sale Of Residential Property

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How Much Tax Will I Pay If I Flip A House New Silver

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax 101

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Yield Cgy Formula Calculation Example And Guide

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Capital Gains Tax What Is It When Do You Pay It

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Selling Your Home Low Incomes Tax Reform Group